It’s Usually a Slow Journey to the Top

As the world returns to more in-person events, I’ve been playing catch up with occasions to be with like-minded colleagues. I’ve just returned from New York where I took part once again in the Institute for Family Governance’s annual conference.

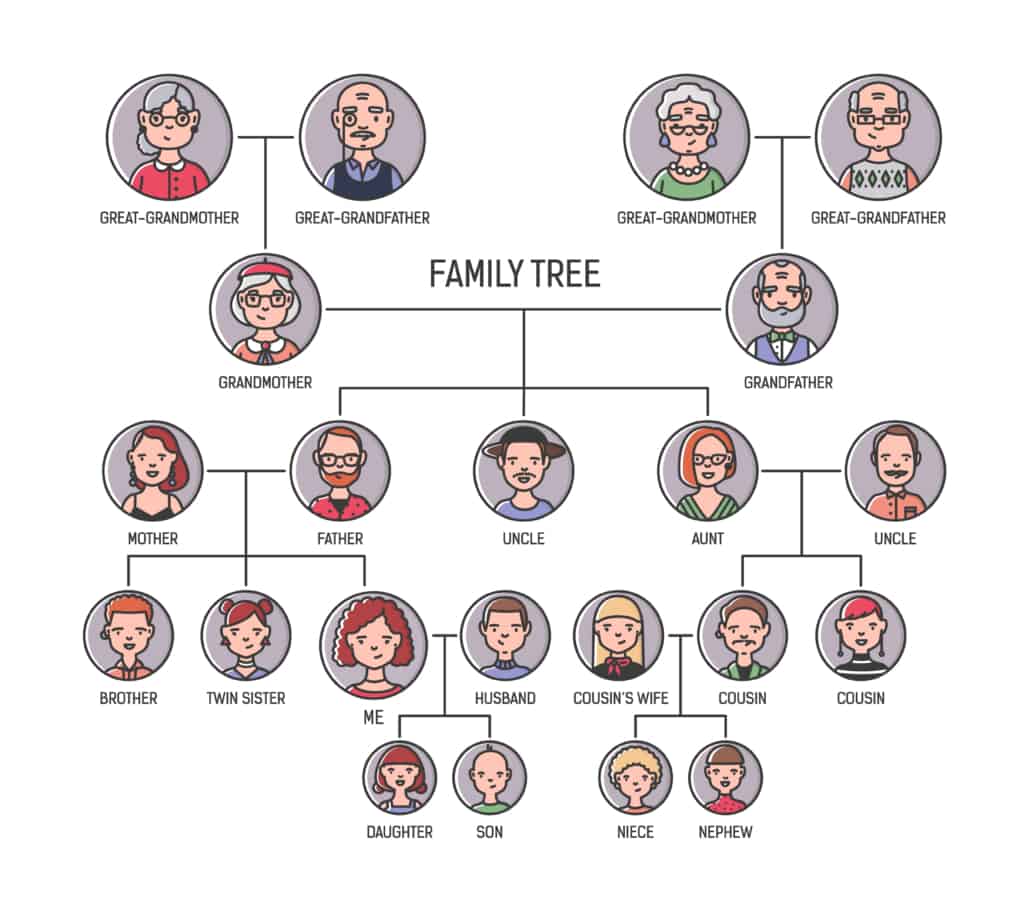

I also got in some family time with my sister, my nephew, and my son, so that was a nice bonus.

Since family governance is about improving relationships among family stakeholders, this opportunity of combining the conference with personal family catch-ups was a big plus.

When thinking about a subject like family governance, I normally like to look at it from each individual family’s perspective, since no two families should approach it the same way.

However, meeting with colleagues who all work somewhere in this space allows me to also take the pulse of the professional community to see how the subject is understood and received in general, and I’m left with mixed feelings on that score.

Caring Enough to Understand

Some of those who showed up didn’t seem to care enough to try to understand the family relationship aspects that actually create most families’ governance challenges.

Perhaps I was jaded by some interactions at my lunch roundtable, but the subject of the families and their challenges in establishing some sort of governance seemed far from the radar of many colleagues.

Having self-selected to come to this conference and sign up for a table to discuss “Family Considerations when Designing your Family Office”, I had assumed that they’d care enough about it to try to understand better.

Or maybe they didn’t understand enough to care; maybe some of each (?).

Enough about the negative, because as usual, the presentations contained many positive nuggets worth remembering and sharing.

Some Random Nuggets to Share:

Josh Baron kicked off the morning discussing Owner Strategy for Family Enterprises, and he reminded us all how important the owners of any business are and the roles that they can and should play as owners.

The group of owners is much more than whatever it happens to say in their shareholder’s agreement, and he was encouraging them to work together with intentionality.

What Does the IRS Have to Do with This?

A panel after that shared a couple of nice take-aways, notably that it’s important not to let the IRS decide things for you.

This underscores the need to make plans in advance of anyone’s death, although I suspect that for many, those plans are actually precisely about making decisions that are very much driven by the desire to deprive the IRS of any of the family’s dollars!

They also noted that there’s a serious lack of role models for generational stewardship for families to learn from.

I think this is largely true, and hopefully changing for the better.

On Family Business Boards:

Brendan Wall then shared his lived experience in his eponymous family enterprise, discussing How to Design and Implement an Effective Family Business Board.

Keeping the Board fresh by rotating directors on and off was noted, as was the need to put the right people on the Board in the first place.

He also mentioned that the qualities of who should be on a Board differ widely when looking at outside independent directors versus family members who sit on the same Board.

A G5 Keynote to Remember

Matthew Fleming’s keynote on the Importance of Family Values was fantastic, as he shared stories from the heart about his family, who are now in G5 (the fifth generation of his family), and how their multi-family office maintains their family’s values at the center of the work they do with all the families they serve.

He shared their model of the Four Pillars of Capital, and also left us with an existential question:

“Is your family office becoming a bigger problem than

the problem it was designed to solve?”

Hmmmm, as any family office heading towards a generational transition knows, this is an important thing to consider, as a need to evolve to serve the rising generation will emerge at some point.

More Nuggets:

After lunch we were treated to some wonderful examples of families who Use their Family Fortune to Serve their Community, as well as trip down memory lane for sailing fans, featuring a member of a three-generation family who repeatedly won the America’s Cup.

Next years IFG Conference in NYC is set for May 3, 2023, and I’m looking forward to being there once again.

I hope we’ll all be a few steps closer to the top of the family governance mountain then.