Please Stop Calling it a “TRANSFER”

Many families know that they should be planning for the eventual transition of their wealth or business to the next generation, but they avoid the issue for as long as they can.

This is unfortunate, and causes all sorts of problems the longer they delay things. The longer you wait the less good options you have available to you.

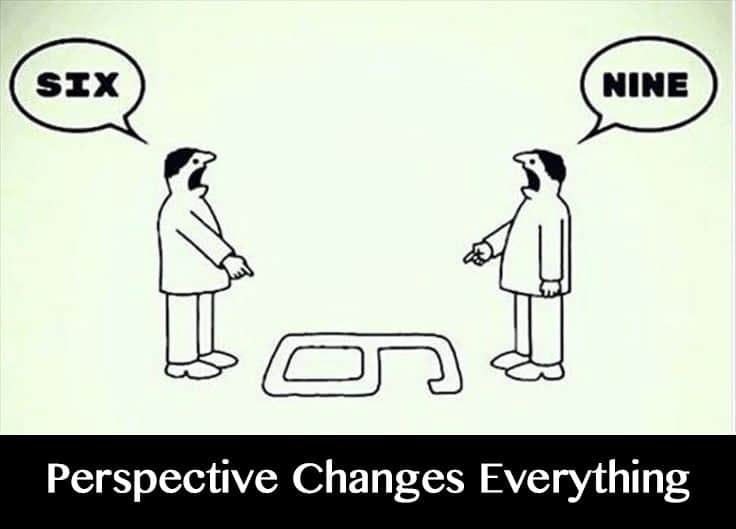

They put these important discussions off because they’re usually looking at this the wrong way, in my estimation.

Too often, they’re thinking about a “transfer”.

They really need to learn to consider this as a transition, or, better yet, a series of transitions.

A Process Versus an Event

A Process Versus an Event

I’ve tackled some of this here before, like back in 2018, in Don’t Transfer Family Wealth, Transition It.

One idea I shared then was that transfer is a word that’s often associated with a one-time event that takes place, whereby something is in one place at point A, and then “whoosh”, there’s a transfer, and now it’s at point B.

Transfers are typically pretty instantaneous.

The way a family looks at its enterprises and wealth, though, and how it should best move from one generation to the next, should be much more gradual, and needs to be planned that way.

But what about the “unpacking” that I teased, and the “series of transitions” I already mentioned? I’m glad you asked.

When you get right down to it, there are actually at least four parts to this complex question.

A Simplified Example

Because this gets messy as you add more people, I’ll use the simplest possible example, where only one parent owns and manages everything at the start of the example, and eventually only one of their offspring will own and manage it all.

You can imagine that if we have both parents and a sibling group, like many real-world examples, it gets hairier quickly, but I’m trying to demonstrate that even the simplest cases are more involved than they first appear to be.

My goal is to break this down into bite-sized steps, because the elders who put these discussions off just may be more willing to engage with the ideas in this piecemeal way.

Level 1 – Management of the Assets

One key element that needs to move from one generation to the next is the management of the business or the assets. We’re talking about the day-to-day oversight of whatever the business does in terms of operations or how it’s wealth is invested.

Non-family employees or outside professionals are also very likely involved in some aspects of this management and those people take their instructions and cues from someone who’s part of the family. At some point the rising generation person will need to learn how to handle this part of things.

This is sometimes the first thing that gets transitioned, as the younger person learns on the job, starts to get involved in things, and eventually becomes the person in charge of managing the day-to-day activities.

Level 2 – Leadership Roles

One level up from the management we find leadership, which has us moving away from the simpler day-to-day of management, but now looks at some of the higher level choices that need to be made.

Hiring and firing of employees and choices of advisors are a couple of elements that come into play here.

The junior family member eventually needs to be able to take over these roles as well, but not necessarily at the same time as they assume the management roles above.

Level 3 – Power and Authority

Even after the senior person has transitioned out of their management and leadership roles, they may still continue to exercise power and authority over many of the decisions. That sometimes only comes years after ceding the first two.

Level 4 – Ownership

Finally, there’s the legal ownership that needs to transition. This can take place all at once, or gradually, which is what I typically recommend, whenever possible. Portions of ownership can be transitioned as some of the other transitions are progressing.

Planning It This Way, AND Executing It Too

These four layers can and should be separated into these components when planning for transitions, and also when executing them.

An overlapping of responsibilities between both generations is a good thing, because these elements are rarely mastered in a day.

Hopefully this breakdown will help some families get moving.

The earlier you begin, the more good choices you have.