Over the past 8 months or so, I have taken on a renewed interest in family businesses and what makes them different and what makes them tick. I have enrolled in courses that do a great job of teaching what family business is all about and how and why they are special.

The courses have covered some in-depth ideas like having a family mission statement, holding regular family meetings, setting up a board of directors with non-family members, getting advisors from different fields to work together harmoniously, facilitating meetings and helping with conflict resolution.

But the single most important thing that I learned was right at the beginning of each course. And it is still the most powerful place to begin any discussion with a family businessperson. It is called the Three-Circle Model. It is SO simple, yet we kept coming back to it during the courses.

The Three-Circle Model (TCM) has only been around for twenty to twenty-five years or so. I am not sure who gets the credit for it, and I would not be surprised to learn that its exact origin is disputed. I recently read an artice from the 1980s that was still talking about family business from a “Two Systems” point of view, which leads me to believe that the TCM evolved afterwards.

(Note from 2016: Please see http://johndavis.com/three-circle-model-of-the-family-business-system/ for more on the origin of the model)

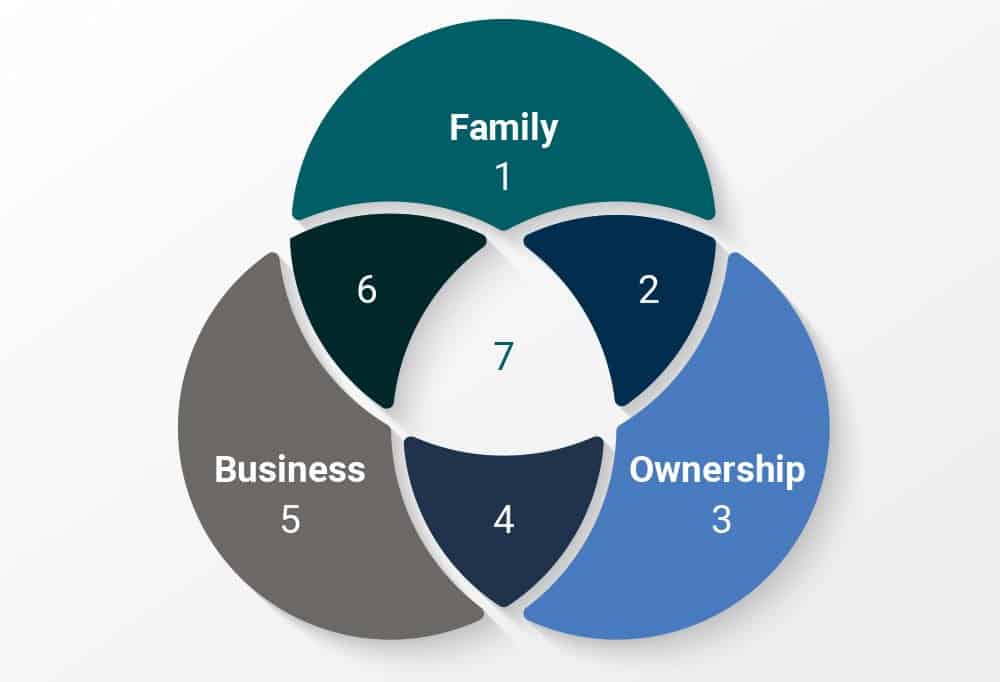

Without further ado, the 3 circles are, “Family”, “Business”, and “Ownership”. F-B-O, a simple Venn diagram of three overlapping circles.

The premise is this: Most people look at a family business as one thing, one entity, one system. But upon closer inspection, there is a LOT more going on there. So in the 80s they started to look at how the Family and the Business were different, and needed to be looked at separately. Later, it was determined that Ownership was also worth spinning out as its own circle.

So part 1 of my equation above in the title of this post is the TCM. What about the seven sectors? Glad you asked. When you draw the TCM as a Venn diagram, you get seven different sectors. Picture yourself asking a three-year-old with a box of Crayolas to colour each portion with a different crayon; they would need seven of them.

So why is this important to Family Businesses? Well mostly because the people who inhabit some of those sectors aren’t even part of the family business. Some of them are part of the Business Family!

People who are only in one circle (the 3 sectors without any overlap) will look at the family business much differently than those who are in one of the three sectors within a two-cirlce overlap.

And then there are those in the middle sector, who are part of the Family, who work in the Business, AND who are also part of Ownership. They often lament the fact that everyone else doesn’t see things the same way as they do!

People who inhabit different sectors will view things in different ways. It is only natural.

Once you learn to view any family business through the TCM, it is like turning on a floodlight. All of a sudden some things that were difficult to comprehend become more easily understood.

And then when you realize that the four sectors where there are overlaps are the ones you need to really concentrate on, you can start to make a lot of progress. I like to think of this as the “flashlight” stage.

The TCM was the floodlight that allowed us to see many things in a new way. Shining the flashlight into the nooks and crannies of the overlapping sectors will help uncover the key areas that will need to be monitored and worked on going forward.

For a visual perspective on all this, please visit my website: click here